private placement life insurance uk

Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. 1 of 4 Life Insurance.

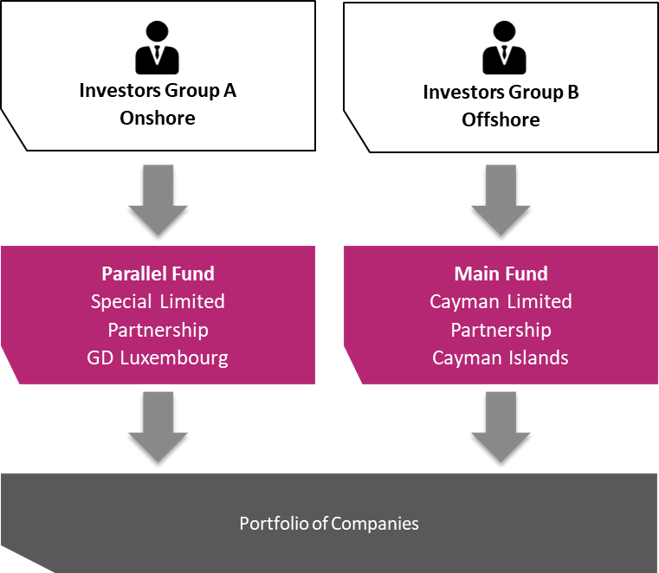

Private Equity Services And Investment Deloitte Luxembourg

What Is Private Placement Life Insurance.

. With the CAGR this market is estimated to reach USD million in 2029. You buy traditional life insurance primarily for death benefit coverage Of course a Variable Universal Life VUL type of policy may be somewhat similar to the PPLI at a foundational level You buy a private placement life insurance for investment and tax benefits. Private placement life insurance or ppli is a customized version of variable rate insurance not available to the general public.

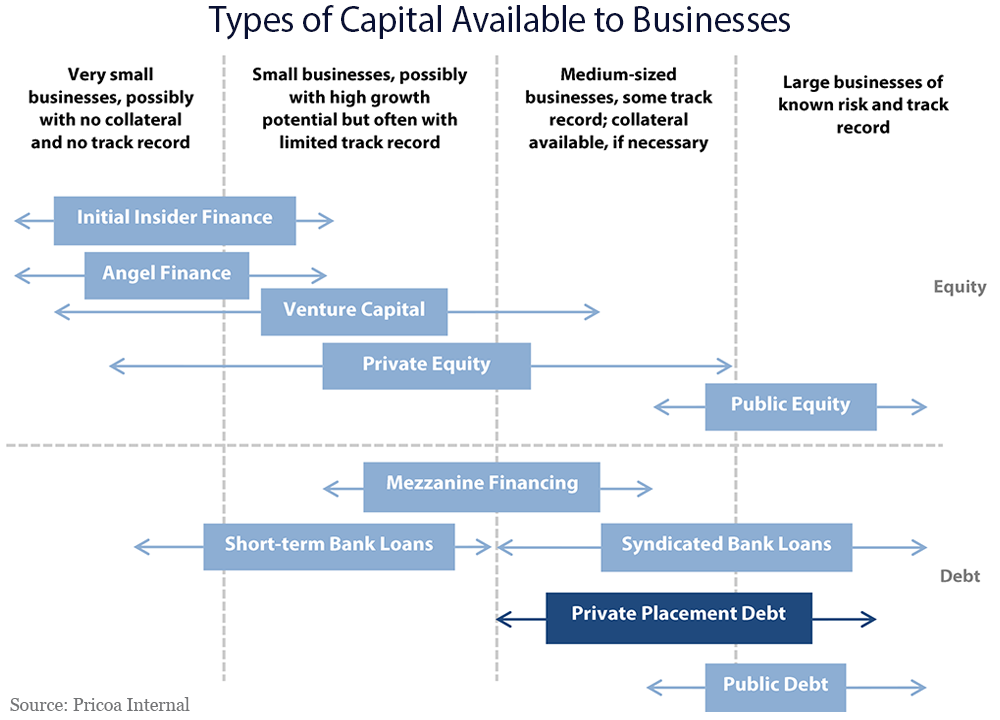

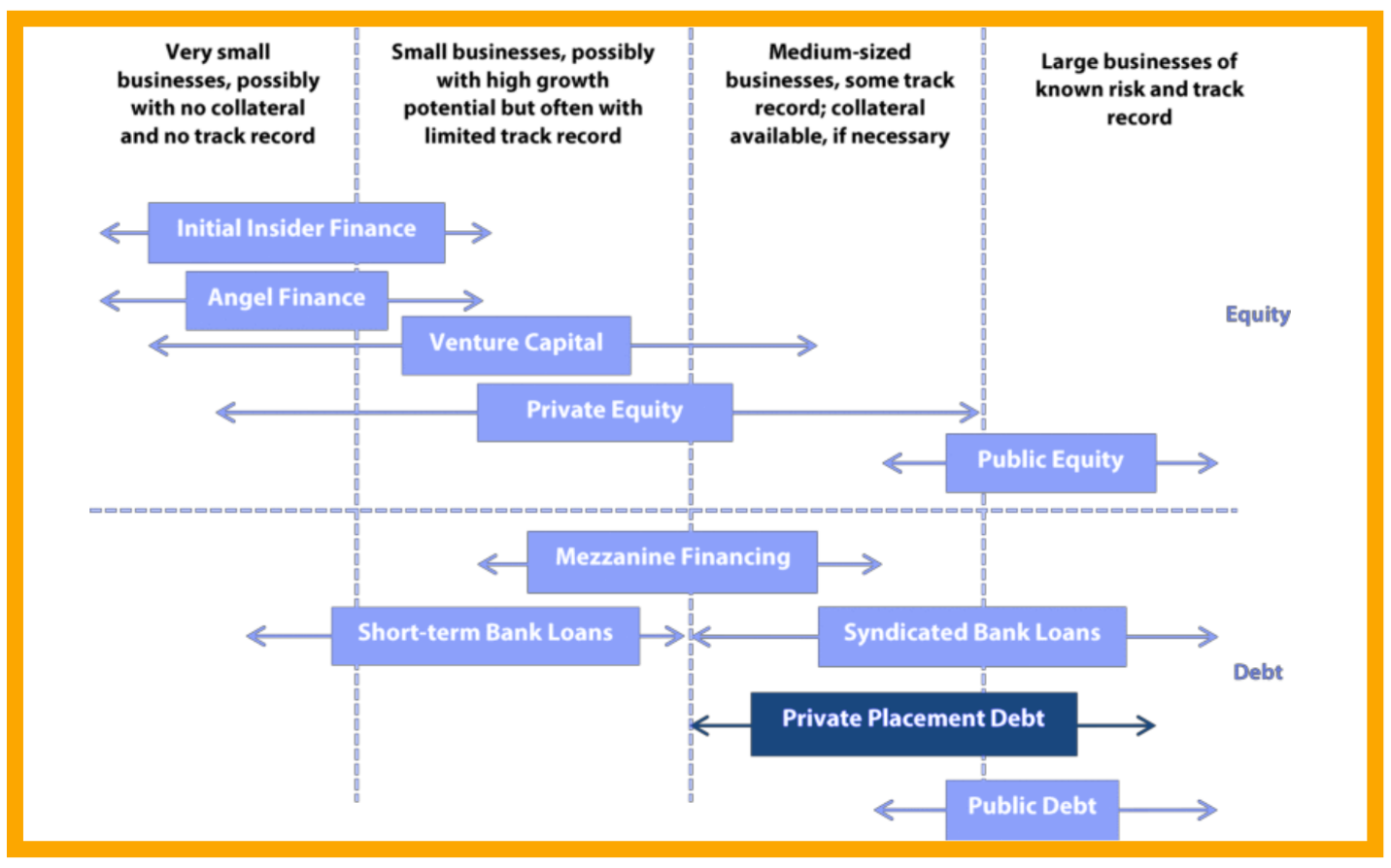

A private placement is essentially the private sale or placement of corporate debt or equity securities or issue by a company or issuer to a limited number of investors aka lenders. It has many advantages but it also has limitations. The product is called private placement life insurance or PPLI and like some other types of life insurance policies a portion of the premiums paid by a.

Private Placement Life Insurance. Ill close by noting that. Private placement life insurance PPLI is institutionally priced life insurance designed for wealthy investors who want to avoid the taxes of hedge funds.

The trust settler grantor may also be a beneficiary. Due to its nature private placement life insurance is only offered to qualified purchasers seeking to invest large sums of money often more than US1 million in the policy. The Private placement life insurance is basically a niche solution for wealthy individuals in high tax brackets with a few million dollars to invest.

The Private Placement Life Insurance PPLI market has witnessed growth from USD million to USD million from 2017 to 2022. Private Placement Life Insurance May 2022. Private Placement Life Insurance PPLI.

The PDF attachment explains what basic life insurance is and what types of people might require it. The pdf attachment explains what basic life insurance is and what types of people might. David Steinegger CEO of Lombard International explains Private Placement Life Insurance.

Private placement insurance helps produce strong companies promotes innovation and spurs job growth. The idea behind PPLI is to combine the financial advantages of hedge funds with the tax benefits of life. In its most basic form PPLI is a type of permanent cover life insurance offering a broad range of investment options into which the insurance company invests premium payments via segregated accounts on a tax free basis.

Historically insurance companies refer to investments as purchasing notes while banks make loans Types of Capital Available to Businesses. Ppli Efficiency Balance Life Insurance Policy Life Insurance Insurance. Remember PPLI is a very niche product.

However FCA guidance states. In addition to beefing up HMRC resources and imposing requirements on tax planners to notify HMRC when new planning arrangements are developed in advance of implementing them draft legislation currently under consultation in the UK would go as far as imposing. Using PPLI as an investment vehicle has the potential to provide for complete tax deferral on investments held within the policy whilst allowing tax-free access to the funds invested over time.

What Is It and Who Needs It. Private placement life insurance PPLI serves as a wrapper around a global variable investment portfolio that grows free of income and capital gains taxes. Private placement life insurance or PPLI is a customized version of variable rate insurance not.

One solution to many of the changes can be to advise the client to invest in a life insurance policy such as a PPLI. Private placement life insurance PPLI is a special type of life insurance that initially originates from the United States. If you have been hearing about private placement.

Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. May 5 2022. Private Placement Life Insurance or Annuities Private Placement Life Insurance PPLI and Private Placement Variable Annuities PPVA are offshore insurance solutions that are investment driven.

Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances. A private placement issuance is a way for institutional investors to lend to companies in a similar fashion as banks with a buy-and-hold approach and with no required trading or public disclosures. Private placement life insurance is a customizable investment product designed to offer the death benefit and tax advantages wrapped up in one low-cost policy.

The UK private placement regime is set out at Chapter 3 Part 6 of the Alternative Investment Fund Managers Regulations 2013 the AIFM Regulations and in Rules and Guidance in the Financial Conduct Authority FCA Handbook. Only a specific group of wealthy individuals can obtain this policy mostly because it solves a very particular wealth management issue. Private placement life insurance is a form of cash value universal life insurance that is offered privately rather than through a public offering.

Private Placement Life Insurance Uk Private placement life insurance ppli is a special type of life insurance that initially originates from the united states. Following the 2018 US Tax Reform Act the use of private placement life insurance PPLI is becoming increasingly prevalent in the US but its benefits remain relatively less known outside of the US. At the trustees discretion the trust may access policy cash value by withdrawals and tax-free loans during the life of the insured.

There is no definition of private placement. In its most basic form PPLI is a type of permanent cover life insurance. Benefits of private placement life insurance.

A hedge fund is like a mutual fund only with a more aggressive investment strategy and higher risk. In addition an attorney will be needed to help draw up the documents adding to the cost of the purchase. With the authors.

PPLIs are structured as variable universal life insurance policies. Suitable for high net worth and ultra- high net worth individuals private placement provides tax and investment management benefits.

What Happens If You Lie On Your Life Insurance Application Bankrate

Real Estate Private Equity Career Guide

How Does Private Placement Life Insurance Work Valuepenguin

Real World Private Placement Examples And Their Impact On The Businesses

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

:max_bytes(150000):strip_icc()/dotdash-career-advice-investment-banking-vscorporate-finance-Final-6c88b378459d43fabfc4474e194bcb29.jpg)

Investment Banking Vs Corporate Finance What S The Difference

How To Complete A Private Placement

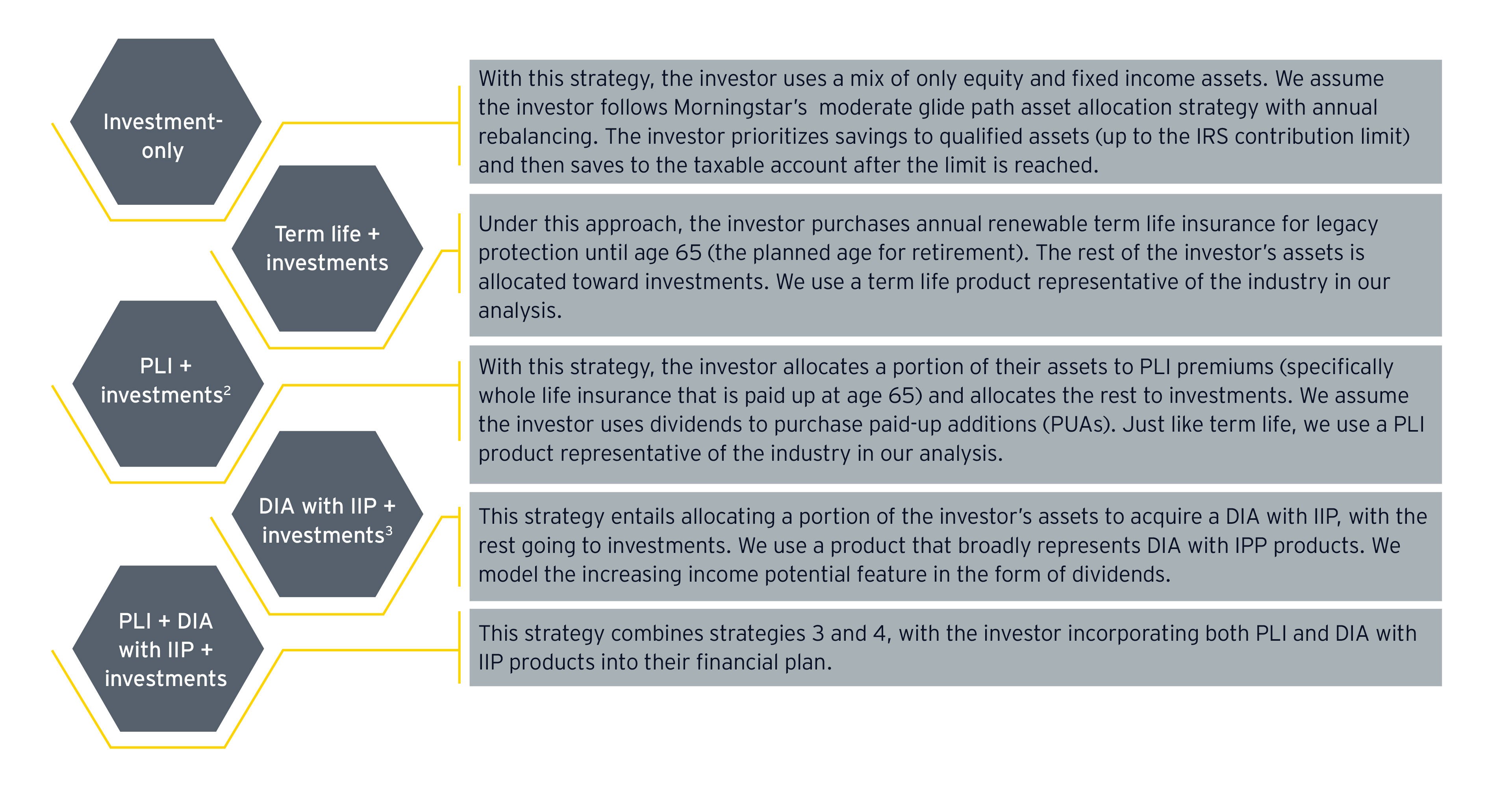

How Insurance And Investments Can Improve Financial Wellness Ey Us

Private Equity International Pei Global Private Equity News Analysis

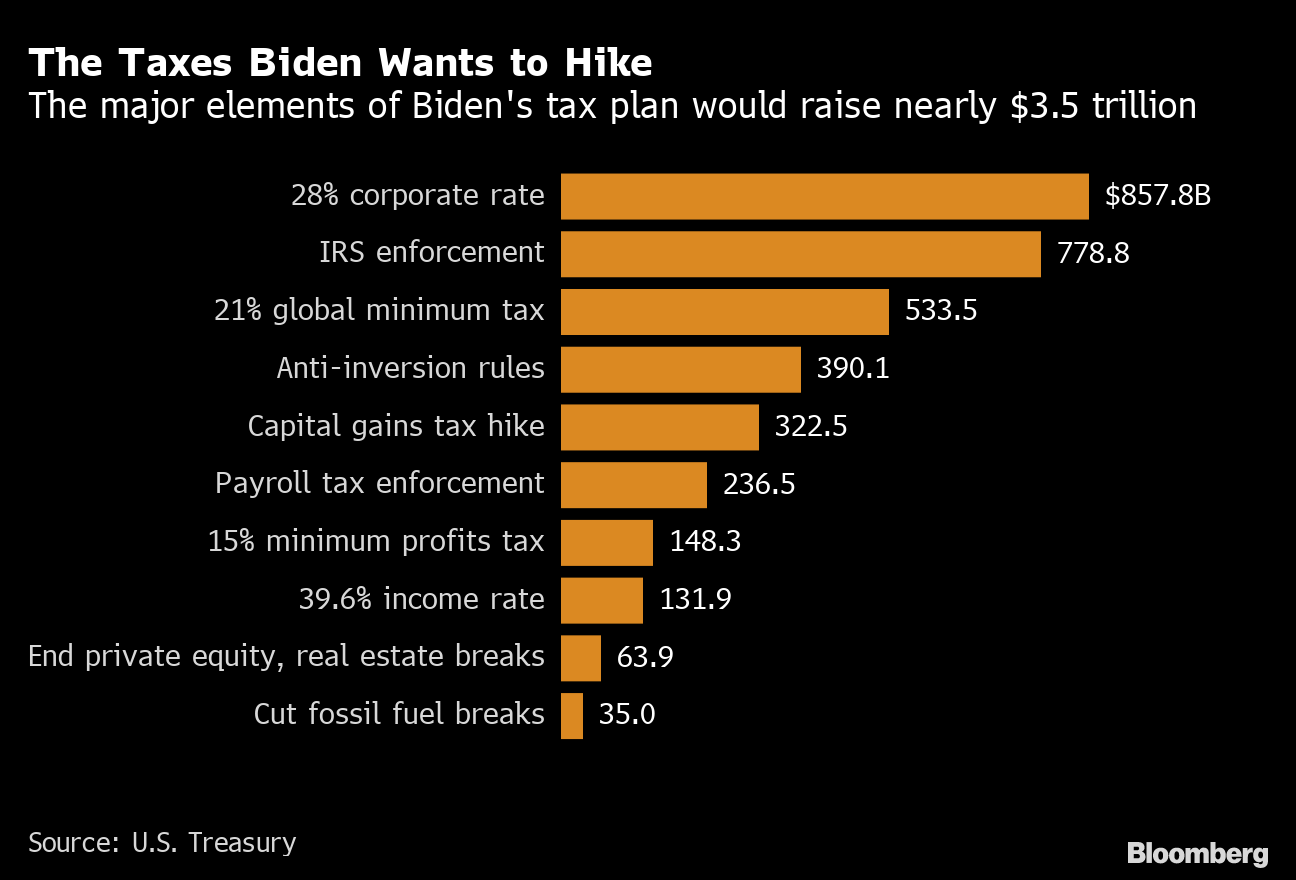

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Mergers Acquisitions M A Advisory

Top 10 Pros And Cons Of Variable Universal Life Insurance

Swiss Life Companies Enter Into Deferred Prosecution Arrangement For Abusive Private Placement Life Insurance Policies

What Happens To Your Life Insurance When You Leave A Job Bankrate

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

High Net Worth Life Insurance Solutions Deutsche Bank Wealth

Private Placement Life Insurance Ppli Considerations For Alternative Investments